Originally published by NSR, an Analysys Mason Company on April 26, 2024. Read the original article here.

“‘As-a-Service’ business models will be an increasingly compelling choice for MNOs thanks to their potential to generate new revenue opportunities and optimise the cost of rural deployments.”

Satellite backhaul presents one of the most promising opportunities for mobile network operators (MNOs) and the satellite industry. New ‘as-a-service’ business models are lowering the barriers to market entry and are facilitating MNOs’ adoption of satellite services by reducing the need for high initial capex and specialised space knowledge. These new models are enabling MNOs to access satellite backhaul solutions in a more cost-effective way, thereby helping to generate new revenue opportunities and optimise the cost of rural deployments.

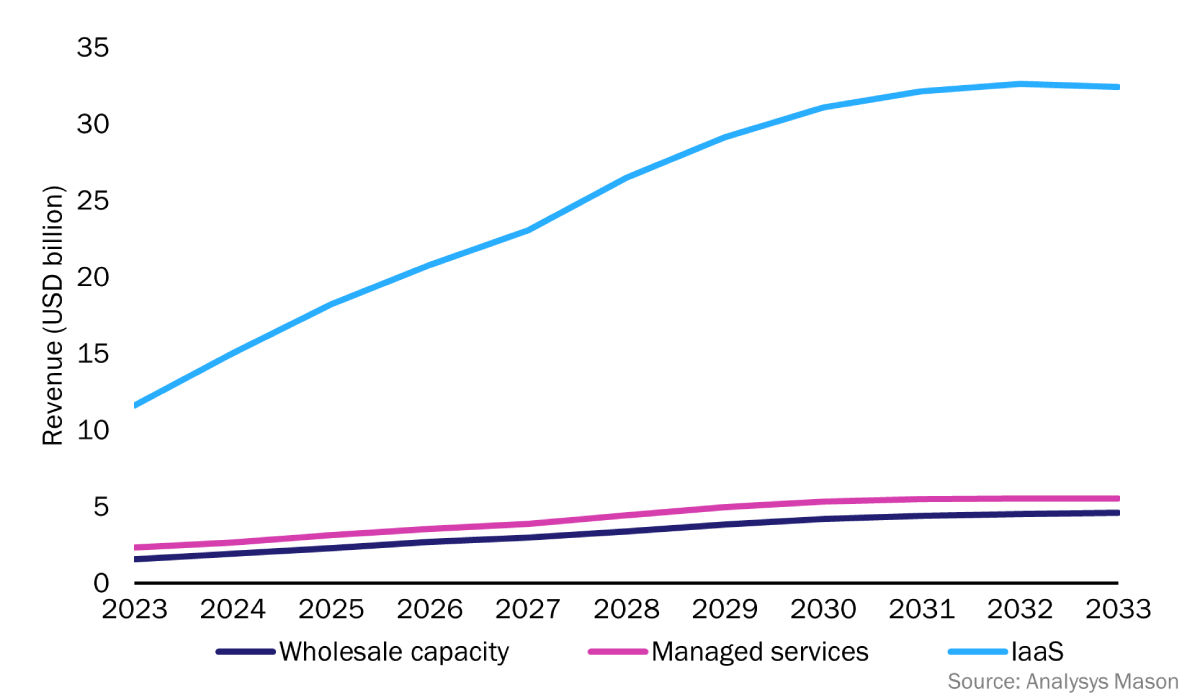

Analysys Mason’s Wireless backhaul and trunking via satellite, 18th edition explores the satellite backhaul and trunking market. We forecast that cumulative infrastructure-as-a-service (IaaS) revenue will reach USD272.6 billion for the 2023–2033 period, and will grow at a CAGR of 10.8% throughout the forecast period (Figure 1).1

Figure 1: Backhaul capacity and service revenue, worldwide, 2023–2033

Figure 1: Backhaul capacity and service revenue, worldwide, 2023–2033

As-a-service business models offer a range of services that are designed to streamline and simplify the management of the various technical components within network systems. Managed services and IaaS solutions are the two ends of the spectrum; managed services can be used to manage satellite capacity, hubs and networks, while IaaS solutions manage all connectivity elements, including the radio access network (RAN), towers and energy. In between these models, there are cases where satellite integrators manage only certain components such as terminals. It should be noted that the boundaries between these models are fluid; different solution providers may have different definitions of these models, and it is crucial that MNOs identify solutions that are best suited to their network infrastructure, expertise limitations and business objectives.

As-a-service models allow MNOs to optimise the costs of rural deployments

Historically, there were several barriers to the adoption of satellite technology for MNOs, namely the significant upfront infrastructure costs and a pervasive knowledge gap. MNOs were required to cultivate specific skill sets to implement satellite technology effectively. However, the advent of as-a-service models allows MNOs to overcome these barriers by facilitating the deployment and maintenance of satellite backhaul sites using managed services and third-party integrators. This has significantly reduced the financial burden for MNOs in terms of initial capex, thereby making satellite backhaul a more viable option, especially in ultra-rural locations and for smaller operators. The new models also enable MNOs to focus on their core competencies because they do not need to develop internal teams to implement and manage satellite links.

As-a-service models enable satellite players to stimulate demand and increase value capture

As-a-service models also help satellite players to stimulate the adoption of satellite backhaul and open up new opportunities beyond raw capacity, thereby helping them to overcome adversity amid continual price erosion.

Monetisation models vary; one option is to use subscriptions whereby clients pay a regular fee for the services. This provides a steady revenue stream for the providers and allows clients to predict their expenses. Other options include pay-per-use, revenue sharing and leasing services. Flexibility is critical to optimising the partnerships between MNOs and satellite players.

Several challenges must be addressed to successfully implement as-a-service models

Financial and infrastructure challenges

Access to funding is a significant hurdle to satellite deployments due to the high initial capex. Indeed, a lack of funding often slows down the pace of establishing sites. For example, major players such as AMN and NuRAN have been experiencing deployment delays as a result of limited financial resources. Additionally, the investment in local gateways and building local teams need to be justified by an adequate number of sites, otherwise there is a risk that the return on investment (ROI) will be insufficient. Some satellite operators are attempting to mitigate this by investing directly in satellite integrators (for example, Intelsat is investing in AMN and Spacecom is investing in NuRAN).

Location and accessibility issues

Sites are often deployed in ultra-rural, hard-to-reach locations, which makes operations challenging. The lack of paved roads and the time it takes to reach these locations for installation and maintenance can significantly reduce the efficiency and cost-effectiveness of these services. As such, it is important to invest in reliable and durable equipment to reduce the frequency of maintenance visits. Local teams with specialist knowledge are useful when tackling rural deployment challenges, and building partnerships with local communities can help to ensure quick issue resolution.

Affordability issues

Affordability is another concern, particularly given the low income levels in ultra-rural locations. Networks will need to be highly optimised for cost to make it attractive and affordable for the local population. Working with government agencies, social inclusion programmes and local communities can also help to address the issues.

Other operational challenges

Power consumption must be a consideration when deploying in ultra-rural locations because the electricity grid is not usually available. Security, access to devices, literacy and cash management are also significant challenges that need to be addressed to ensure the successful deployment and operation of as-a-service models. These factors all contribute to the complexity of providing such services and need to be carefully considered and managed.

Note that we treat both infrastructure-as-a-service and network-as-a-service solutions as IaaS.

Originally published by NSR, an Analysys Mason Company on April 26, 2024. Read the original article here.