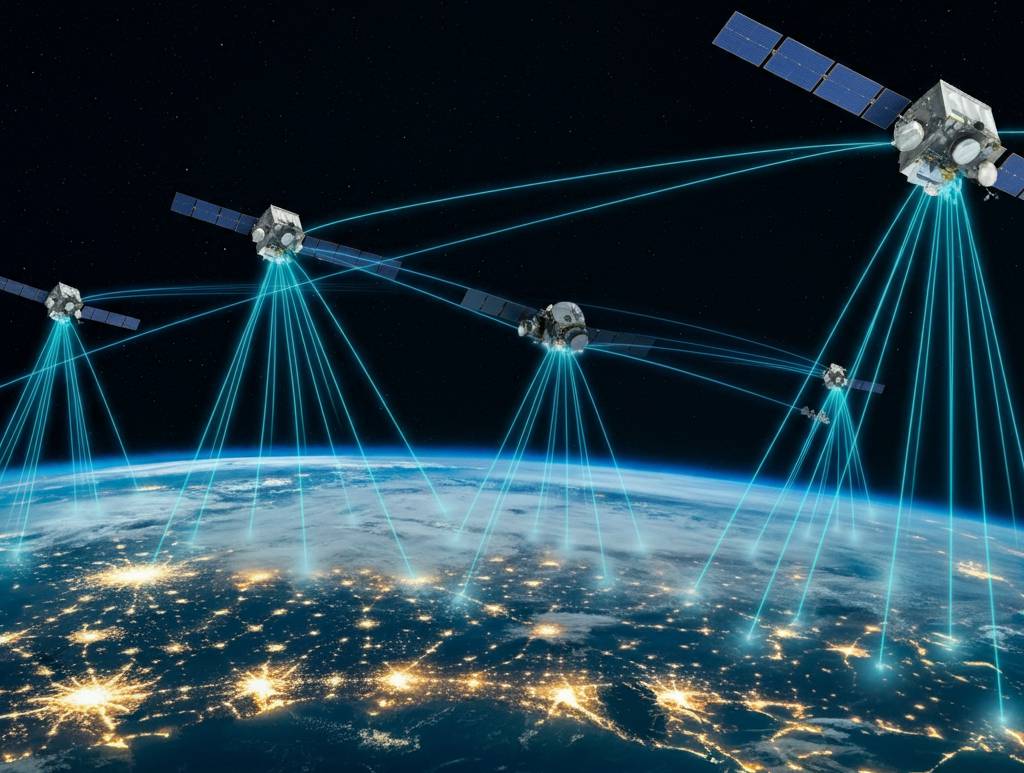

WASHINGTON – Recent years have brought important progress in the long-awaited convergence between the once largely separate satellite and terrestrial telecommunications grids, but considerable work remains to reach a state where the two operate seamlessly as one.

Satellite capabilities, which in the cellular world were once relegated primarily to behind-the-scenes applications like backhaul, are increasingly being integrated into the front-line offerings of mobile network operators (MNOs) for broadband delivery and roaming. Some MNOs are even investing in satellite ventures, a clear indication of their growing interest in convergence, according to Dimitri Buchs, managing consultant at Novaspace, a space- and satellite-focused consultancy.

Key drivers of the trend include the emergence and promise of low Earth orbiting (LEO) satellites to deliver low-latency connectivity almost anywhere, the ongoing decline in the broadcasting business that has long been the bread and butter of traditional geostationary orbit (GEO) satellite operators, and perhaps above all the relentless growth in demand for data for mobility and other applications.

“Convergence with the terrestrial grid is absolutely pivotal to the future of the satellite telecommunications industry,” said Eva Berneke, chief executive of Paris-based Eutelsat Group, which operates constellations in both GEO and LEO. “As we look ahead, the integration of satellite and terrestrial networks represents a significant opportunity to enhance connectivity on a global scale. This convergence will enable a more seamless and robust communication experience, bridging gaps that currently exist between different network infrastructures,” Berneke said in a written response to questions.

David Wajsgras, chief executive of longtime GEO operator Intelsat, whose acquisition by longtime rival SES is undergoing regulatory review, said satellites can extend the reach of MNOs for existing and emerging applications. “MNOs and telcos are looking to us to help strengthen and expand their networks and enable new use cases for the value-added solutions that build on those networks,” Wajsgras said in a written response to questions.

Jean-Luc Vuillemin, CEO Executive Technology Advisor at Orange, said satellite technology provides coverage in areas beyond the reach of terrestrial infrastructure as well as overall network resiliency. In addition, satellite connectivity can be deployed rapidly in emergencies, he said. “Satellite is not our core business but it's core to our business,” he said.

Technology enablers

Experts generally agree that some of the longstanding technical barriers to satellite-terrestrial convergence are coming down. Satellite operators, for example, have begun to make the transition to digital operations that have been widely adopted by terrestrial operators.

“We’ve been in an analog world that looks like a 2G network with proprietary systems and proprietary hardware,” Phil Carrai, president of Kratos’ Space division, said in an interview. “We need to look more like a 4G or 5G network.”

The satellite side needs to move away from proprietary hardware to infrastructure that runs on standardized computing systems and embraces interoperability standards developed in conjunction with the terrestrial industry, Carrai said. “As we are already seeing, the potential in adopting accepted standards such as 5G can open new service offerings for satellite operators and new opportunities to work together with terrestrial and mobile providers,” he said.

In a written response to questions, Vuillemin expressed frustration at the slow pace of progress on satellite industry-wide standards.

“It is more a question of the willingness of the satellite operators than a technical problem,” Vuillemin said. “To get there the satellite operators have to work together for common standards and common approach and very little seems to be done in this direction.”

Vuillemin used connectivity to cars as an example, saying that switching network providers today requires all new car equipment. While feasible, if painful, for large platforms like ships, this is impossible for cars, he said.

Transition to 5G

The brewing transition to the 5G network standard “will be a catalyst for transformation,” Carrai said.

The 3G Partnership Project, a global consortium that develops network interoperability standards, continues to work on Non-Terrestrial Network (NTN) standards to integrate satellite services into 5G. Carrai said 5G, with NTN at its core, will enable certain roaming applications, such as in-flight connectivity, that today require extra steps for the user and specialized equipment on the provider side. “It lowers the friction that a mobile network operator has for using space,” he said. “Space becomes just another participant in their network.”

Sumaiya Najarali, senior consultant with Novaspace, said the satellite role in current 4G class networks is primarily limited to cellular backhaul to remote areas, but 5G will open up new use cases, accelerating convergence. Several satellite operators cited the Internet of Things (IoT) in remote areas as a growing application that will benefit from emerging LEO satellite services.

But the transition to 5G might not happen as quickly as many would like, Najarali and Buchs said in an interview. Deploying 5G networks is an expensive proposition, and many markets where satellite could make a big difference are still operating on 2G and 3G services, Najarali said.

“Operators are hoping for a big boost with 5G,” Buchs said. “The reality is its going to take more time than they anticipate.”

Things certainly are not happening quickly enough as Vuillemin would like. “I must say that I am quite disappointed by the small progress made recently in 5G integration in satellite networks and constellations,” he said. “There was great enthusiasm and momentum two years ago but it seems that the promise is taking more time than expected to be delivered.”

The LEO factor in convergence

Emerging LEO services, most notably by SpaceX’s 6,000-satellite Starlink constellation, are creating new incentives for terrestrial operators to integrate satellite into their mix of offerings.

“Next generation LEO constellations provide low latency, fiber-like performance that can expand the reach of terrestrial offerings to every point on Earth,” said Daniel Goldberg, president and chief executive of Ottawa, Canada-based Telesat, which is developing the 198-satellite Lightspeed system to complement its existing GEO constellation.

Telesat designed Lightspeed for easy integration with terrestrial networks, incorporating features including ethernet connectivity standards and automated orchestration processes already used by MNOs, Goldberg said in a written response to questions. “With this design approach, terrestrial providers can quickly integrate Telesat Lightspeed connectivity using the same standards they already use in their terrestrial networks,” he said.

Eutelsat’s Berneke emphasized the ability to combine LEO and GEO services to meet the needs of terrestrial operators. “By doing so, we enable MNOs to extend their network coverage and improve service quality across diverse environments,” she said.

Wajsgras of Intelsat concurred, saying multi-orbit capabilities are critical if satellite companies are to become fully integrated solutions providers, as opposed to “best efforts” providers of bandwidth. “Customers should not have to compromise on trade-offs among reliability, latency, security, or coverage,” he said. “Multi-orbit solutions will allow the customer to leverage all these benefits via a single handoff from the satellite operator.”

Looking ahead

While broadly bullish on the prospects for convergence, satellite operators and technology providers agree there is still work to be done to reach a state where providers can deliver seamless connectivity to customers regardless of which path the signals take. Satellite operators must continue to invest in new technologies, both on the space and ground segment, while also embracing practices that enable space sustainability, a growing concern given the proliferation of LEO constellations, Berneke said.

Wajsgras cited standardization across vendor platforms, virtualization of functions to reduce the footprint of remote-site hardware, and electronically steered multi-orbit terminals as areas of emphasis going forward.

Affordable terminals that are interoperable across orbits and frequencies remains a technology challenge for the industry, Carrai said. “And it’s also the network behind the terminals,” he said. “Is it software-defined and orchestrated to be adaptive and flexible?”

Another issue has been delays on large, very-high-throughput GEO satellites that will help continue to drive down the cost of bandwidth, Carrai added.

Indeed, operators cited affordability – along with reliability and standards-based interoperability – as foremost among the minds of their terrestrial counterparts.

“Cost efficiency remains a critical consideration” for MNOs, Berneke said. “Providers are looking for satellite services that offer competitive pricing models and deliver a strong return on investment, helping them to manage operational costs while expanding their service capabilities.”

Explore More:

A Field Guide to 5G Standards in Satcom/Telecom Integration

Satellite-Mobile Convergence Is Driving Disruption and Opportunities

Podcast: Mainstreaming Satellite, Embracing MEF Standards and Enabling Service Delivery in Minutes