Credit: EchoStar

Credit: EchoStar

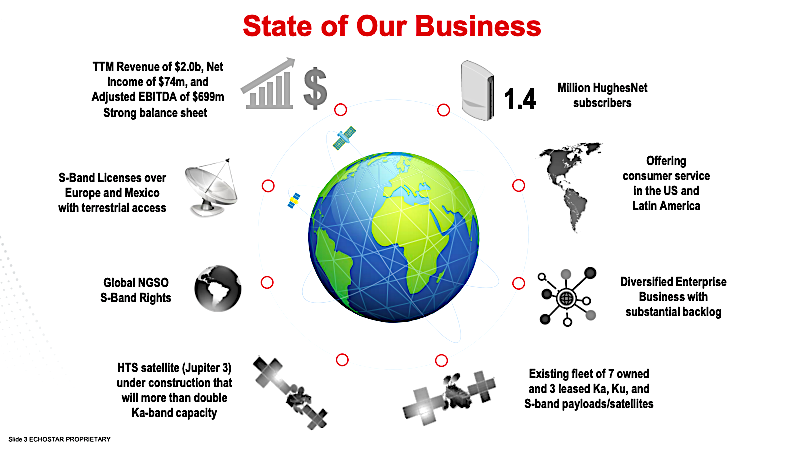

PARIS — Industry observers have only one question for EchoStar Corp.: What does the new chief executive, Hamid Akhavan, want to do with the Hughes Network Systems and EchoStar Satellite Services businesses and the $1.5 billion in cash on EchoStar’s balance sheet?

EchoStar Chairman Charlie Ergen told investors in February that Akhavan would have wide latitude in setting the company’s direction: Read more

In EchoStar’s May 5 investor call, Akhavan acknowledged the pressure on him but said he’s not the run-and-gun type and will need another few months to set the company’s direction.

Pradman P. Kaul, chief executive, Hughes Network Systems. Credit: EchoStar

Pradman P. Kaul, chief executive, Hughes Network Systems. Credit: EchoStar

The outside world did not welcome him with great news. Hughes President Pradman P. Kaul said Jupiter 3 manufacturer Maxar Technologies, already more than a year late in delivering the satellite, will not be ready to ship it until Q1 2023.

Kaul said Maxar informed Hughes that the latest delay, to Q1 2023 from Q4 2022, “is due in part to a reallocation of critical resources at Maxar to a higher-priority government-related spacecraft project.”

That looks like insult added to injury given the program’s history. But Kaul never moves out of unflappable mode and said only: “We are disappointed in this delay but remain highly excited about Jupiter 3.” He did not identify the Maxar project that bumped Jupiter 3, but it’s likely Maxar’s six-satellite Legion constellation of high-resolution optical reconnaissance spacecraft.

The U.S. National Reconnaissance Office is the biggest customer for these commercial satellites, which are scheduled to launch in pairs starting this summer, at three-month intervals: Read more

The 500-Gbps Jupiter 3’s importance to Hughes’s consumer broadband business is made more clear every quarter as Hughes reports declining consumer broadband subscriptions.

U.S. subscribers declined by 3.2% in the three months ending March 31 compared to last year, to 1.055 million. In Latin America, subscriptions were down 5.6%, to 351,000.

David J. Rayner, EchoStar Chief Operating Officer & Chief Financial Officer. Credit: EchoStar

David J. Rayner, EchoStar Chief Operating Officer & Chief Financial Officer. Credit: EchoStar

Kaul and EchoStar Chief Financial Officer David J. Rayner said Hughes is pulling out all the stops to maintain EBITDA: increasing subscription rates to cull less-profitable subscribers to focus available satellite capacity on the high-ARPU customers; maximizing development of cellular backhaul and community-WiFi service, and making sure that government and enterprise customers are kept happy.

“We have several initiatives in place to limit the impact” of the Jupiter 3 delay, Rayner said. “We will… protect our margins until we can monetize the additional capacity provided by the Jupiter 3 satellite.”

Credit: EchoStar Corp.

Credit: EchoStar Corp.

So far, these efforts are holding the line: Hughes reported a 3.8% increase in total revenue for the three months ending March 31 compared to a year ago, to $494.1 million. But EBITDA was down by 3.7%, to $191.2 million.

Kaul said that based on new orders booked in Q1, equipment sales this year would not fall off once deliveries of gateway Earth stations to the OneWeb satellite broadband constellation have completed. “That will be a strong part of our performance for the rest of this year,” he said.

The much smaller EchoStar Satellite Services (ESS) business for years has been on the verge of something big in S-band, whether in Europe with the large S-band satellite in geostationary orbit, or globally with S-band spectrum rights secured through EchoStar Global Australia.

The company has launched on small low-orbiting satellite to secure the global S-band spectrum rights. In Europe, ESS continues work on developing products for governments and emergency using its European Union license. Where that business is going is anyone’s guess.

ESS President Anders Johnson, who is also EchoStar’s chief strategy officer, is resigning.

EchoStar Chief Executive Officer Hamid Akhavan. Credit: EchoStar

EchoStar Chief Executive Officer Hamid Akhavan. Credit: EchoStar

Akhavan’s remarks left all doors open but did suggest that he is a believer in the S-band business and is hopeful that a less-frothy satellite investment market that looks to be coming will play to EchoStar’s strength. That’s where the $1.5 billion in cash comes in.

“We have a uniquely strong balance sheet — something that most of our peers and competitors cannot say,” Akhavan said. “The benefit of this… becomes more evident as interest rates rise and the likelihood of a recessionary environment becomes meaningful.”

Credit: EchoStar

Credit: EchoStar

He asked investors not to read much into Johnson’s departure, saying the ESS business, especially the S-band play, has his full attention.

The 3GPP wireless broadband standards organization’s Release 17 adds satellite and atmospheric broadband platforms to the 5G ecosystem.

“Satellite 5G specifications include direct access to hand-held devices,” Akhavan said. “S-band spectrum assets are standardized in 3GPP. EchoStar is positioned to become a leading global operator of 5G mobile satellite services addressing direct-to-device mobility and IoT applications.”

The EU business, Ireland-based EchoStar Mobile, is starting tests of a satellite placed LoRa IoT service. LoRa, or Long-Range, technology provides low-power, secure transmissions to M2M/IoT devices.

And the balance sheet? “We will be more active in using our cash and our abilities to expand our business using our resources,” Akhavan said. “We are one of the few companies with the significant ability to chart our future independently of what other players choose to do. We might do even better in terms of opportunities in a down market.

“If it turns out the market is softening — and we have seen valuations come down from overinflated values — then the market is heading our way.”

Read more from Space Intel Report.