Originally published by Space Intel Report on August 7, 2024. Read the original article here.

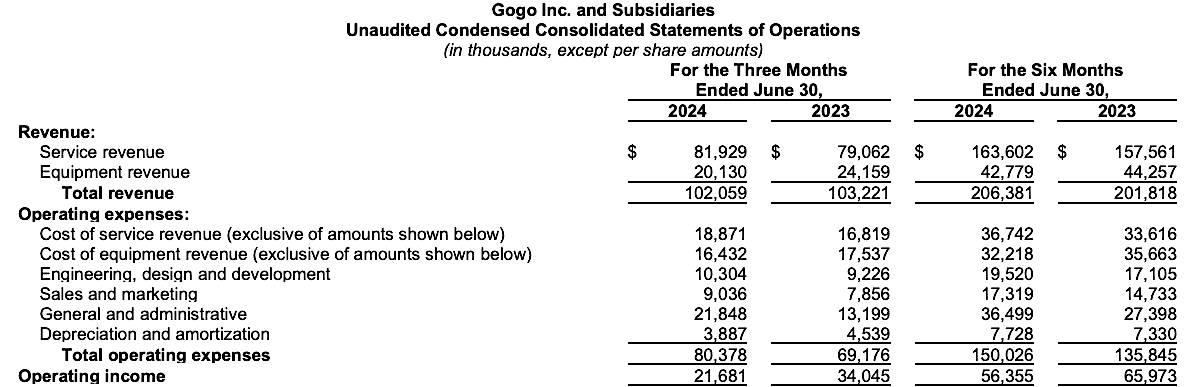

(Source: Gogo)

(Source: Gogo)

TUPPER LAKE, NY — Business Aviation in-flight-connectivity provider Gogo Inc. laid out the case for why Gogo’s OneWeb service will be superior to SpaceX’s Starlink for most business jets when it comes on line in 2025.

Gogo is upgrading its product line in the coming year, adding 5G service to its North American air-to-ground network and offering a OneWeb service that Gogo calls Galileo LEO.

The company is seeing its equipment sales fall off sharply as customers wait for the new Galileo and 5G products. Gogo is incentivizing customers that move to its existing Avance platform by making the switch to 5G or Galileo LEO relatively easy.

In an Aug. 7 investor call, Gogo Chief Executive Oakleigh Thorne said the company’s decision, four years ago, to sell its Commercial Aviation business to satellite fleet operator Intelsat for $500 million and to use the proceeds to invest in new technology for Business Aviation has proved correct.

“Average megabit consumption has risen 165% from Q2 2019” before the Covid pandemic, Thorne said. “There has been a step change in passenger demand and average megabits consumed per flight hour, which has risen 96% over that same period, and a 17% annual growth in Q2.”

Instead of becoming a Starlink distribution partner, Gogo has decided to cast its lot with OneWeb. The two companies signed a long-term distribution partnership in May 2022.

OneWeb has been delayed in getting its gateway Earth stations deployed, but Thorne said the network should be in place in time for the Galileo LEO rollout.

Then the test will come as to whether Business Aviation customers will follow Gogo’s lead or instead switch to Starlink.

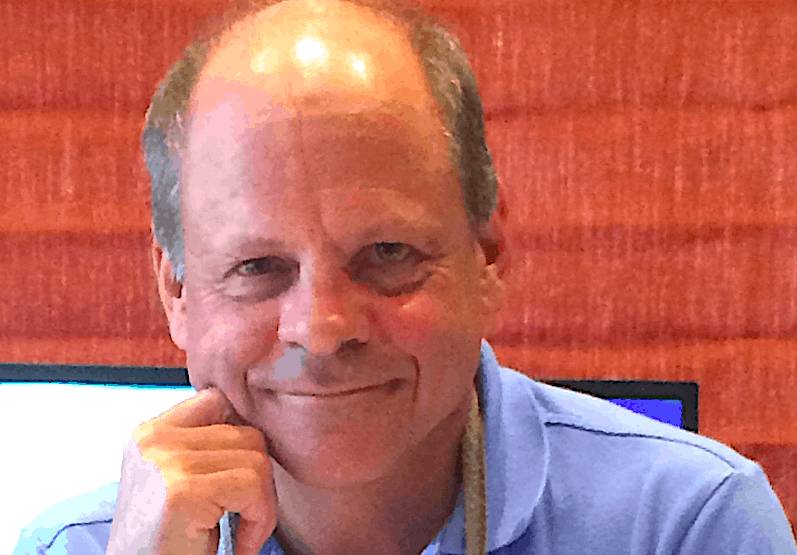

Gogo Chief Executive Oakleigh B. Thorne. (Source: Gogo)

Gogo Chief Executive Oakleigh B. Thorne. (Source: Gogo)

Here’s Thorne’s argument.

“We anticipated that Starlink would become a significant competitor, which has become evident as they ramped up installations in Q2. Although we will launch a little later than Starlink, we will launch with a product that addresses much more of the market than their offering.

“They have done us a big favor: They have made the BA market aware of how much better LEO technology is for BA in-flight connectivity than traditional GEO satellite solutions”

Thorne said he likes the image of a mouse feasting on cheese from a trap that has already been sprung. In this telling, it’s the second mouse that gets the cheese.

Starlink, Thorne said, “is just a repurposing of their consumer off-the-shelf product for aviation use and does not meet [Business Aviation] demands. That opens the door for meaningful product differentiation on our part, centered in three areas:

“Our equipment is aviation grade, designed from the aircraft up and the satellite down for the specific needs of the aviation market. Theirs is consumer grade. You can buy it at Best Buy and it’s repurposed and poorly suited for aviation.

“Second, our business model is business-aviation focused, with the type of personal customer support someone who just spent $80 million on an aircraft would expect from a service provider. Theirs is a web-based, appointment-only chat service that does not allow customers direct access to aviation technicians.

“Finally, OneWeb is an enterprise-grade network designed to serve B2B customers with service-level guarantees, while theirs is consumer grade, aimed at 5 billion consumers and many other markets with highly variable speed levels, a best-efforts-only service obligation and no commitment to fixed pricing.”

(Source: Gogo)

(Source: Gogo)

Maritime connectivity services providers said the same thing about Starlink a couple of years ago, only to find that some of their customers are willing to do without service-level-agreements and Committed Information Rates because the Starlink offer is so much better than GEO satellite connectivity.

Gogo’s Galileo comes in two versions, a smaller HDX terminal offering 60 Mbps for smaller aircraft and North American jets that want faster connections than Gogo’s average 25-Mbps 5G product.

The larger FDX antenna, which is still smaller than Starlink’s terminal, offers consistent 145-195 Mbps performance for larger jets.

Customers of Gogo’s Avance platform, which is 60% of Gogo customer aircraft now, have the added incentive of what Thorne said is a simple upgrade to Galileo.

“Just add our antenna on top of the fuselage, then run a data cable that is already installed in the Avance box on the aircraft, add power cabling from the aircraft to the Galileo terminal and you are done, cutting roughly $100,000 off the cost of the Galileo installation,” he said.

Pricing: The HDX and FDX service plans will cost slightly more than Starlink given the added value of the service-level commitments and help-desk.

“There are a million little things they are kind of wrong about how they are going about things,” Thorne said of Starlink. “It’s consumer-grade, so there are questions about how long it will reliably stand the rigors of Business Aviation — 130 degrees inside the cabin before passengers arrive to minus 60 degrees at 40,000 feet.”

And the raw throughput? “Our network will perform about the same as Starlink’s,” Thorne said, in addition to having the performance commitments.

Originally published by Space Intel Report on August 7, 2024. Read the original article here.