Originally published by Space Intel Report on August 2, 2024. Read the original article here.

(Source: KVH)

(Source: KVH)

TUPPER LAKE, NY — Maritime connectivity provider KVH Industries, which is remaking itself into a smaller company that works with LEO constellations instead of competing with them, said it has begun to see results from its new focus.

In an Aug. 1 investor call, KVH Chief Executive Brent C. Bruun said KVH showed a small increase in its subscriber vessel count for the three months ending June 30, reversing a recent downward trend. He said the company shipped a record number of communications antennas during the period.

KVH reported having just under 6,700 subscribing vessels as of June 30, up 1% from the count at March 31.

KVH is phasing out its own antenna-manufacturing capability as part of a broad downsizing that will result in $9 million of cost savings per year, including $5.4 million in annual operating expenses.

The company reported $49.3 million in cash at June 30. During the quarter, it expanded its relationship with SpaceX’s Starlink broadband constellation with the purchase of $17 million of Starlink Mobile Priority service “at favorable rates,” the company said in an Aug. 1 filing with the U.S. Securities and Exchange Commission (SEC).

“The new agreement offers us increased flexibility in the development and sale of custom airtime plans using Starlink’s Mobile Priority service.” The agreement covers more than one year of capacity use, the company said.

KVH began selling Starlink terminals alongside its own VSAT gear in March 2023 and became and authorized Starlink terminal and airtime reseller in September.

March 2023, KVH began selling Starlink terminals and in September 2023 became a Starlink authorized hardware and airtime reseller. It is now a bulk distributor.

KVH has begun testing the OneWeb broadband LEO constellation service on a couple of its ships and will offer that commercially later this year.

“Our industry is changing rapidly,” Bruun said “Stand-alone VSAT subscriptions have declined faster than anticipated. We have been nimble and taken steps to adjust our business model. We’re seeing continued growth in VSAT-LEO hybrid solutions and a reduced churn for those deployments, which indicates that commercial fleet managers and leisure boaters realize the value of our hybrid approach.

“We are anticipating subscriber growth in the third quarter and hope that this trend continues. We believe we are on the right path and will emerge from our reorganization as a world-class solutions provider built on global airtime and superior service and support.”

Bruun acknowledged that KVH is likely to see further declines in its own VSAT business as its smaller leisure-boat customers replace KVH VSATs with Starlink. But for larger commercial fleets, KVH’s package, including 24/7 customer service, is added value they’re willing to pay for.

Monthly customer revenue to KVH from customers using only Starlink is lower than an equivalent customer using KVH’s VSAT, but subscribers taking both VSAT and Starlink generate about the same revenue as previous VSAT-only accounts, Bruun said.

(Source: KVH)

(Source: KVH)

He said KVH has activated more than 1,000 Starlink terminals for new and existing customers since the start of the year and that it’s clear Starlink is enlarging the maritime connectivity market, not simply taking market share from legacy satcom providers.

“We have seen the impact,” Bruun said. “Vessels that previously were not signing up are signing up. Starlink is opening up new markets for smaller commercial and leisure and also fishing. The lower end of the market is opening up. We anticipate it will open further, particularly merchant marine, as we introduce 5G.”

(Source: KVH)

(Source: KVH)

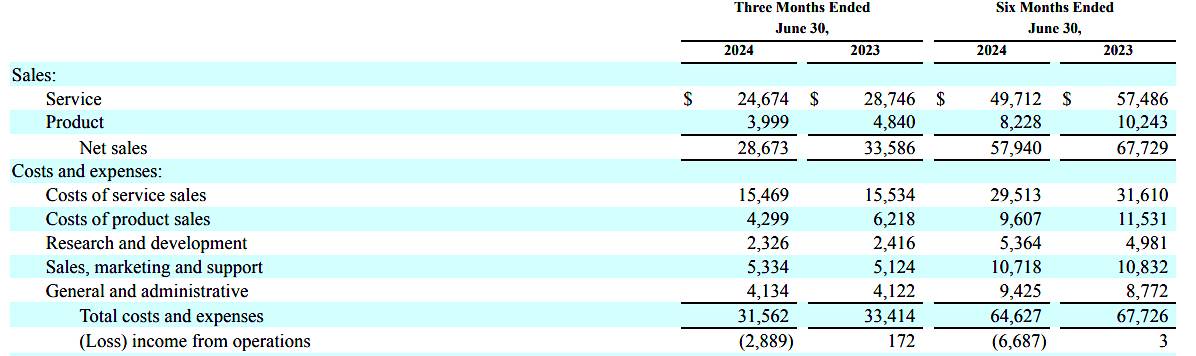

For the six months ending June 30, KVH reported revenue of $57.9 million, down 14.5% from the same period a year ago, and an operating loss of $6.7 million compared to a $3-million gain last year.

The company’s near-term results will depend in part on how quickly the U.S. Coast Guard, a major customer, transitions to Starlink and away from VSAT. The company said it now appears that the Coast Guard is accelerating the move.

“[T]he anticipated decline in revenue from this customer will occur earlier, reducing the aggregate amount of revenue we expect to receive from this customer in 2024. We anticipate that this decline will begin in the third or fourth quarter of 2024,” KVH said in its SEC filing.

“Although we are adapting to [the market shift to LEO constellations] by becoming an authorized reseller of Starlink, OneWeb and cellular data services and related products, there can be no assurance that we will generate the same level of revenue or gross margin from these sources that we derived from sales of VSAT airtime and related products,” KVH said. “Moreover, our VSAT services require a separate infrastructure, which generates certain costs that are relatively fixed for a period of time.”

KVH offers near-global connectivity under contracts with fleet operators Intelsat and Sky Perfect JSat. It has been letting some of these capacity-lease contracts expire as it downsizes.

“We have the network appropriately sized for the installed base right now,” Bruun said “We have some flexibility to reduce bandwidth as we move forward.”

Originally published by Space Intel Report on August 2, 2024. Read the original article here.