Originally published by Analysys Mason on September 24, 2024. Read the original article here.

“Government-funded lunar programmes are experiencing challenges and delays but they will continue and will therefore stimulate significant commercial activity and opportunities.”

A second space ‘race’ back to the Moon is happening now, and the lunar market is a real opportunity. The USA is investing time and money in sending people to the Moon, as it did during the ‘Apollo era’ of the 1960s. This time, the USA’s project Artemis is competing with China’s International Lunar Research Station (ILRS).

Artemis is an ambitious programme (43 countries are participating) that has experienced several challenges. NASA has cancelled some Artemis missions, and the agency’s report suggested in July 2024 that the Artemis 3 mission only has a 70% chance of being ready on time. Concurrently, China’s ambitions are growing; it intends to increase the number of country-level partners for ILRS to 50, up from its current 10.

Considering the technological and political challenges, some view the lunar market as unworthy of pursuit, or unlikely to develop into a truly commercial opportunity.

However, Analysys Mason’s research concludes that the lunar market will be one of the largest satellite manufacturing and launch opportunities in the next 10 years, but one that it is only accessible to commercial players with strong governmental partnerships, diverse portfolios and the ability to support long technology development cycles.

Science, crew and cargo missions represent a USD400 billion revenue opportunity, of which lunar missions account for USD70 billion

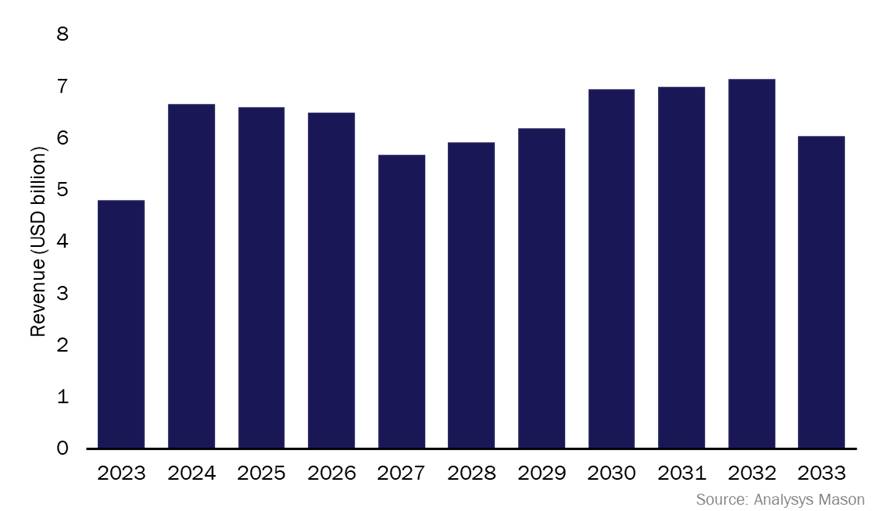

Analysys Mason’s Satellite manufacturing and launch services: trends and forecasts 2023–2033 report forecasts a cumulative revenue opportunity of nearly USD400 billion from science, crew and cargo missions over the next decade (Figure 1). Data from Analysys Mason’s Lunar markets, 4th edition forecast report indicates that lunar missions will generate at least USD70 billion between 2023 and 2033, not including significant research and development funding. For example, NASA’s Artemis mission has reportedly committed USD53 billion in development funding between 2021 and 2025. However, the programme continues to be delayed and challenged, and industry stakeholders have expressed doubts about whether it will succeed and about its accessibility.

Figure 1: Science, crew and cargo satellite manufacturing and launch revenue, worldwide

China and the USA will continue to support lunar programmes in spite of the expense and challenges associated with technology development

China’s ILRS programme has reported that it is likely to achieve its goal of sending humans to the Moon by 2030. The project has taken on many partners, even managing to entice some that are already committed to NASA’s Artemis programme, such as Bahrain and Peru. Geopolitics is a challenge for China; partnerships are slow to form or get cancelled, owing to China and Russia’s involvement. Despite this, the ILRS programme seems well-funded, with a strong structure and strategy in place.

NASA’s Artemis programme has experienced delays and cost overruns. Despite these challenges, the Artemis programme will continue because it has managed to garner widespread grassroot industrial and political support. Geopolitics is a challenge for China, but it is the driving motivation for the USA that will ensure continued support for the programme. Historically, much of the USA’s space activity has been driven by both national pride and international positioning. In short, the USA will not allow China to gain significant scientific and strategic advantage.

Much of the market remains in highly-competitive critical missions, but the wider opportunity is already well-funded

Most of the revenue associated with lunar market activity will be generated through the development of large, high-risk missions for government agencies. Rocket launch, orbital station manufacturing, resource exploration and utilisation are important technologies that need to come to fruition, and will be heavily disputed by a small number of well-established market players.

However, the wider commercial opportunity comes in the form of ancillary missions and services, and the potential development of a commercial lunar market. The latter is a far-off idea, but the former has already begun. Since 2020, nearly USD17 billion in contract funding has gone to commercial players to develop lunar missions and services. Many of the missions and services are aimed at the development of government satellites, rovers and landers, but some are privately funded. In February, a privately funded mission from Intuitive Machines reached the Moon. The landing was not a full success, but it attracted interest from NASA, which later awarded contracts to the company, as well as to Venturi Astrolab and Lunar Outpost for the development of a Lunar Terrain Vehicle. As Artemis missions continue, an ecosystem of support will continue to develop, and represent a sizeable commercial satellite manufacturing and launch opportunity.

Originally published by Analysys Mason on September 24, 2024. Read the original article here.