Originally published by Analysys Mason on July 10, 2024. Read the original article here.

“US civil space players must work to showcase value propositions and spending efficiencies in their plans to ensure that budgets support agency goals.”

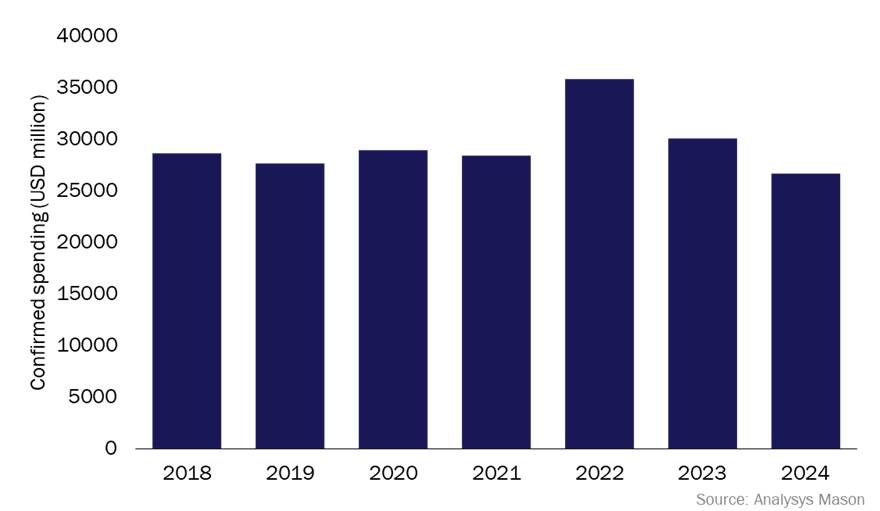

Civil space activity in the USA is facing challenges in 2024. The US government continues to be the world’s largest confirmed spender on civil space activity but our recent report notes that budgetary cuts in 2024 relating to this sector will have impacts that will be felt at least for the next 2 to 3 years (Figure 1). Given this funding trend, how can civil space players in the USA decrease risk and protect their ability to generate revenue?

Figure 1: Confirmed spending on civil space activity, USA, 2018–2024

The civil space market will be challenging in FY2024 because the goals of commercial players do not align with available budgets

Political debate ensured that decisions about the US government’s FY2024 budget continued until the deadline. The budget was approved via two ‘minibus’ appropriation packages and space-associated agency funding was decreased. The cuts associated with civil space activity were visible throughout the budget in line with the Fiscal Responsibility Act of 2023 spending cap requirements. The government will focus on defence-based space activity and increased the Defense Department’s budget for this by 3%.

Departments that focus on civil space activity are now faced with maximising results while minimising expenditure. They need to find solutions to the misalignment between goals and the availability of budgets to achieve them. Public and political scrutiny of commercial contracts will force budget managers to carefully assess ongoing and planned commercial contracts to ensure efficiencies are being achieved during FY2024. Affected commercial entities that are competing for government spending on civil space activity must move now to provide evidence of their utility and social value being mindful that any overrun on budget or time in current projects or missions will make it more difficult to secure funding in the future.

Commercial players that want to capture and retain revenue must demonstrate their value as FY2025 budgets are released

The trend established in the US budget for FY2024 is likely to continue in FY2025 thanks to economic headwinds, internal debates about government priorities, political divides and the ramifications of the Fiscal Responsibility Act of 2023. Planning for FY2025 has begun. NASA has declared that it plans to ask for USD25.384 billion for the year. This is approximately USD2.3 billion less than expected and represents a return to FY2023 levels.

Figure 2: NASA’s confirmed budget FY2024 and planned budget FY2025

| NASA research themes |

Budget FY2024

(USD million) |

Proposed budget FY2025 (USD million) |

| Aeronautics |

935 |

966 |

| Exploration |

7666 |

7618 |

| Science |

7334 |

7566 |

| Space technology |

1100 |

1182 |

| Space operations |

4220 |

4390 |

| STEM engagement |

143 |

144 |

| Safety, security and mission services |

3129 |

3044 |

| Construction and environment |

300 |

424 |

| Inspector general |

48 |

51 |

Source: Analysys Mason

Public organisations and players that rely on US budgetary results for their funding should now look to ensuring that their FY2025 goals are attained. These groups must ensure that their value is front and centre because budgetary spending caps will continue.

Geopolitical instability and national economic challenges are continuing, but civil missions such as the ARTEMIS programme or Mars Sample Return mission will continue to need significant investment; approaches to US spending on space activity may need to change. The ARTEMIS programme is somewhat sheltered by its pushed-out timelines and the social credit involved in achieving such a prestigious mission. Government support is likely to continue here. The ‘if’ is not in doubt but the ‘when’ is less certain. Those looking to engage with the civil budget outside such missions, must, therefore, look to demonstrate, strengthen and promote the value and efficiency propositions of their continued work to align with national trends. Recent contract wins from the National Oceanic and Atmospheric Administration (NOAA), such as by BAE and Hydrosat, have demonstrated that players are interested in using the budget for quick-impact success – for example, by being able to protect humans from wildfires or droughts.

Players should diversify to maximise opportunity and minimum risk until economic challenges stabilise

The US government’s budget for civil space activity has been affected by economic challenges and political shifts that have made this an increasingly risky market to engage with. While the US government is a significant customer, players in this market are advised to diversify their business planning to target several revenue streams to mitigate risk and enhance opportunity.

Such diversification might involve larger companies, or smaller ones in partnership, looking beyond the USA for government spending on space because other countries are becoming increasingly interested in the benefits of the space industry to national activities (for example, satellite communications in disaster response management). Emerging space nations will offer a revenue opportunity for those companies that are ready to engage. Commercial industries should also be considered in business planning. Providers of financial and healthcare services are developing satellite-associated activity such as telemedicine. Players that continue to depend on a single large-value player opportunities will find it increasingly difficult to thrive; diversification is essential.

Originally published by Analysys Mason on July 10, 2024. Read the original article here.