(Source: SES)

(Source: SES)

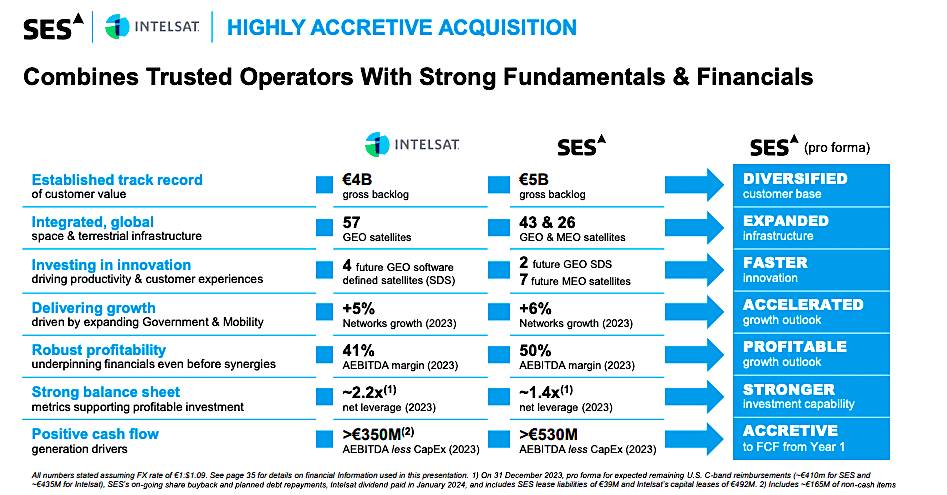

PARIS — SES is acquiring Intelsat for 2.8 billion euros ($3.1 billion) in cash in a transaction that both companies’ boards have approved after concluding that it will not encounter opposition from a major customer, the U.S. Defense Department.

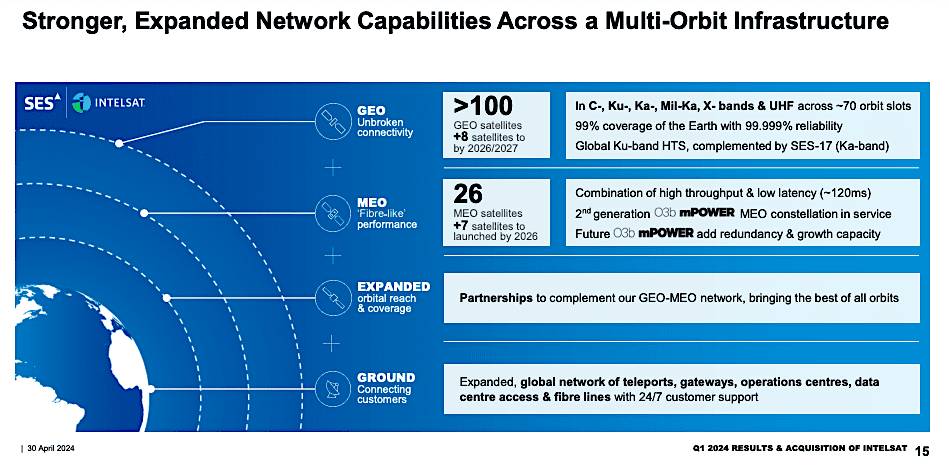

The combined company will have more than 100 GEO-orbit satellites and 26 O3b medium-Earth-orbit broadband satellites at the deal’s expected closing in late 2025. They have eight more GEO-orbit satellites, all software-defined designs, and seven more O3b mPower MEO-orbit spacecraft to be in orbit by late 2026.

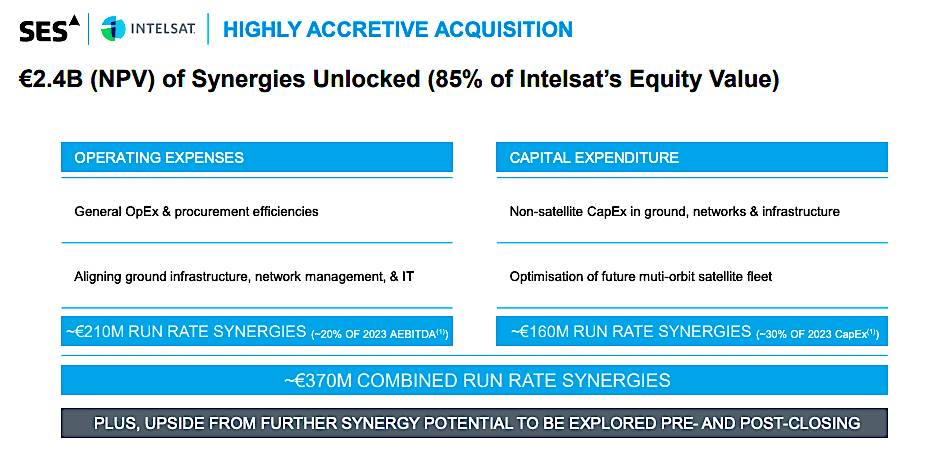

As would be expected in a union of the two largest GEO-orbit satellite fleets, the merger is expected to generate 2.4 billion euros ($2.56 billion) in synergies, 70% of them to be realized in the three years following the deal’s close.

The synergies — notably a streamlining of their satellite fleets and ground architectures to eliminate overlap — will be 210 million euros ($224 million) a year, which is 20% of the combined companies’ adjusted EBITDA for 2023.

(Source: SES)

(Source: SES)

In an April 30 call with investors, SES Chief Executive Adel Al-Saleh portrayed the transaction as the joining of two companies with perhaps the strongest balance sheets at a time of rapid change in the satellite communications business.

He made oblique mention of new LEO-orbit players and said achieving scope and scale — global coverage, multiple frequencies across more than 70 orbital slots — “is critical to success. Being isolated into one corner of the market is a difficult way to compete in this market,” Al-Saleh said.

The SpaceX Starlink broadband constellation was only mentioned once, in passing, and Amazon’s coming Project Kuiper was not referenced. But those these companies’ financial reach have changed the dynamic for SES and Intelsat, offering competitors whose size means they do not need to concern themselves with short-term shareholder issues and dividend commitments.

The fact that SES and Intelsat believe they need this merger is a testament to the fear traditional satellite operators have relative to Starlink and Kuiper as much anything else.

Highlights from SES’s April 30 investor call on the Intelsat purchase

— Al-Saleh conceded that the two companies will need to make their case to the U.S. Defense Department, a major customer for both, to assuage antitrust concerns. Commercial satellite capacity has become a first-order priority for the Pentagon.

(Source: SES)

(Source: SES)

“Our U.S. government business is north of 350-400 million [euros] per year, not dissimilar to Intelsat’s,” Al-Saleh said.

“The U.S. government space defense budget is several billion and just issued a strategic paper on the importance of commercial integration into their activities. They say they see their architecture is highly dependent on a breadth of commercial capabilities.

“We would not have an overarching share. [U.S. military business] will be spread across a lot of players including the smaller players. We got comfortable that we can have a good outcome. We have some work to do but we don’t see an issue there,” Al-Saleh said.

Effects on Iris2? None, says SES

— The purchase of Intelsat means SES ostensibly has less immediately available cash to invest in the European Union’s Iris2 multi-orbit constellation of secure communications satellites. Iris2 is designed as a public-private partnership in which both the 27-nation European Commission and industry will invest.

But the project has been complicated by diverging interests among the companies in the SpaceRise consortium negotiating the concession contract. The consortium includes satellite operators Eutelsat and Hispasat as well as SES.

Al-Saleh said buying Intelsat is a “complementary” transaction when compared to Iris2, and not a substitute. By creating a stronger SES, he said, Iris2 will be able to generate more commercial revenue for the industrial partners.

“We are all about providing government sovereign capabilities. This transaction positions us even stronger for Iris2. The EU will need to ensure there is high use of that constellation. Having a large player like us to drive traffic into the network is very important. I see that as a complementary situation,” Al-Saleh said.

He said that one of the considerations in assessing an Intelsat purchase was how much SES should set aside for an Iris2 investment. The initial bid from the SpaceRise consortium fell far short of what the European Commission wanted in private sector investment.

(Source: SES)

(Source: SES)

— With synergies and capex savings being a prime driver of the rationale for the transaction, it was clear that Intelsat’s planned MEO-orbit constellation will now be scrapped, with those ambitions merged into SES’s O3b and O3b mPower network.

One consequence: Any satellite builder not named Boeing that had been bidding for the Intelsat constellation is probably out of luck. Boeing is the prime contractor for the O3b mPower constellation.

Boeing has compensated SES for an electronics glitch of the first six mPower satellites by co-investing in two additional spacecraft. mPower is expected to grow, notably by adding satellites in inclined orbits to provide wider coverage, including over the poles. The current constellation is in equatorial orbit at 8,000 kilometers in altitude.

The initial six mPower satellites, despite the intermittent power issue, entered service in April.

Al-Saleh said the results so far have met SES’s expectations. “The biggest challenge is actually allocating the supply that we have,” he said.