Nathan de Ruiter, Partner and Managing Director at Novaspace focused his opening remarks of the World Space Business Week on the need to build an “Android” satcom ecosystem to compete with Starlink. (Source: Novaspace)

Nathan de Ruiter, Partner and Managing Director at Novaspace focused his opening remarks of the World Space Business Week on the need to build an “Android” satcom ecosystem to compete with Starlink. (Source: Novaspace)

History offers valuable lessons, and the Apple versus Android rivalry serves as a fascinating case study in technology design choices and into broader business strategy and market dynamics. Both platforms have achieved success through distinctly different approaches, highlighting the potential for diverse strategies in any industry.

When we overlay this framework onto the satellite communications sector, a compelling analogy emerges. Starlink embodies the characteristics of the Apple model: it features a closed network architecture and a vertically integrated system with proprietary user equipment. The substantial capital investment—approximately $30 billion for GEN 1 and GEN 2—mirrors Apple's significant expenditure in innovation.

In a remarkably short period, Starlink has established a commanding presence in the consumer broadband and maritime communication markets, projected to capture 64% and 39% market share, respectively, by the end of the 2024. Crucially, Starlink has not merely absorbed market share from existing competitors; it has contributed to the overall expansion of the market.

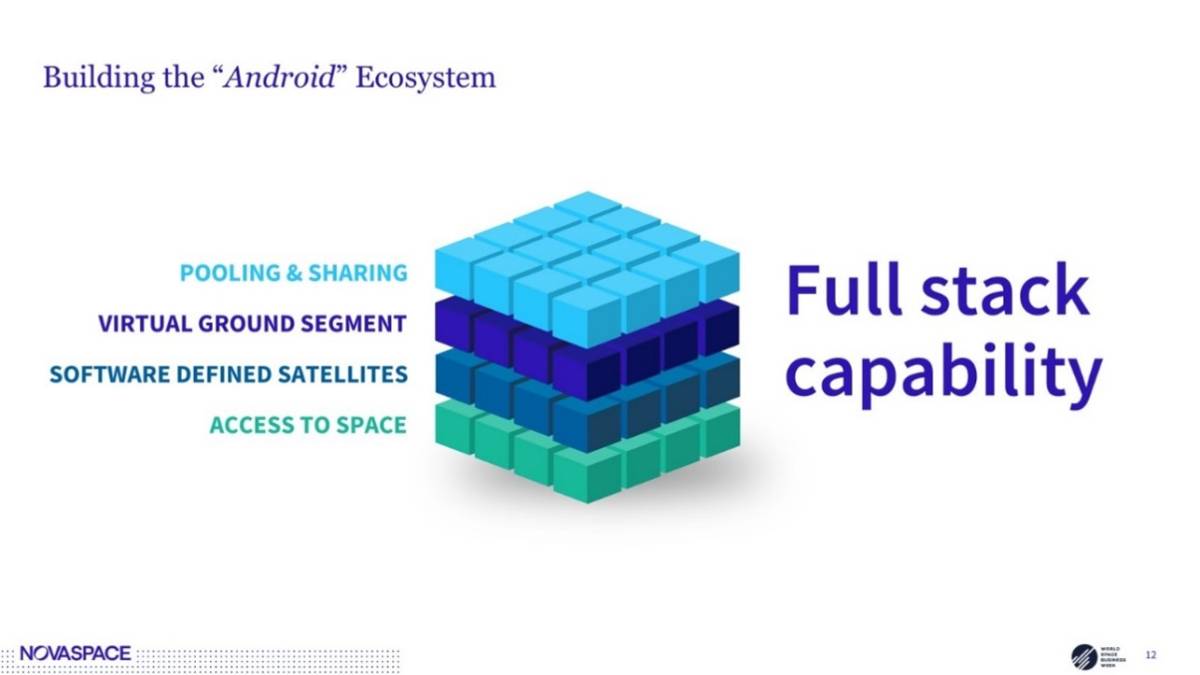

The pivotal question is how other players can build an "Android ecosystem" to effectively compete with Starlink and elevate the entire market. In our view, the Android Satcom ecosystem should be founded on four key principles:

- Access to Space: the industry has increasingly become dependent on SpaceX. In 2024, SpaceX is set to handle 61 out of 69 planned launches. To prevent potential bottlenecks in the heavy launch category, it's clear that we need additional vehicles like Ariane 6 and New Glenn to become fully operational.

- Software-Defined Satellite (SDS) Infrastructure: Recent statistics (14 GEO SDS orders since 2019) clearly indicate a growing trend toward software-defined satellites. The transition toward software-defined satellites facilitates hardware standardization and operational flexibility. However, increasing costs and protracted delivery timelines of SDS present significant challenges that must be addressed to build a robust satellite infrastructure.

- Virtual Ground Segment: To maximize the utility of satellite assets, the sector must embrace multi-orbit terminals, cloud integration, and network orchestration built on open standards. This shall also facilitate the integration of satellite into the terrestrial telecom eco-system. Consequently, virtualization is seen as a key factor contributing to the projected $75 billion in cumulative spending on the ground segment through 2030.

- Pooling and Sharing Resources: The establishment of partnerships is vital to achieving true global service availability. One of the key drivers of Android’s commercial success is that it has become the dominant operating system in markets like India and China. Obtaining global market access has been a major challenge for any satellite operator and this has been no different for Starlink.

The four key principles to build the “Android” Ecosystem. (Source: Novaspace)

The four key principles to build the “Android” Ecosystem. (Source: Novaspace)

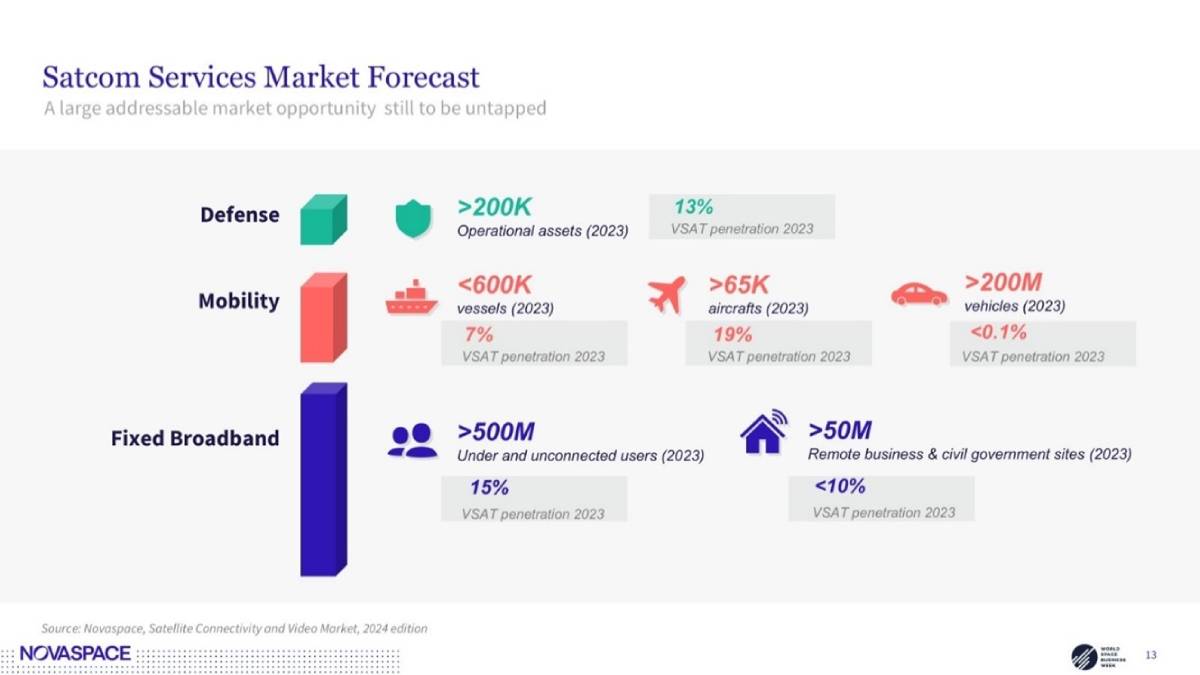

The pivotal question remains whether the satellite communications market operates under a "winner-takes-all" paradigm. Market data suggests that this does not have to be the case. Current VSAT penetration levels across critical verticals—such as fixed broadband, mobility, and defense—remain modest. This data indicates that significant opportunities for growth exist, allowing for multiple players to coexist and thrive within the market landscape.

Satcom Services Market Forecast (Source: Novaspace)

Satcom Services Market Forecast (Source: Novaspace)

In conclusion, while Starlink has made significant inroads, the satcom market offers significant potential for growth through competition and innovation across various segments. As we look to the future, it is imperative that industry stakeholders collaborate to harness these opportunities and cultivate a dynamic ecosystem that benefits all.

Click here to view the full presentation given at the World Space Business Week: https://www.youtube.com/watch?v=jboeAiZEj0w

About the Author:

Nathan de Ruiter is Partner and Managing Director at Novaspace. Nathan brings nearly two decades of consulting experience to Novaspace, offering strategic guidance to an array of international clients. His client-focused approach spans satellite operators, manufacturers, service providers, government agencies, and financial institutions. Nathan’s expertise ensures seamless execution of client engagements, underpinned by robust project management and quality assurance practices. Nathan will lead our transaction advisory services.

Nathan de Ruiter is Partner and Managing Director at Novaspace. Nathan brings nearly two decades of consulting experience to Novaspace, offering strategic guidance to an array of international clients. His client-focused approach spans satellite operators, manufacturers, service providers, government agencies, and financial institutions. Nathan’s expertise ensures seamless execution of client engagements, underpinned by robust project management and quality assurance practices. Nathan will lead our transaction advisory services.