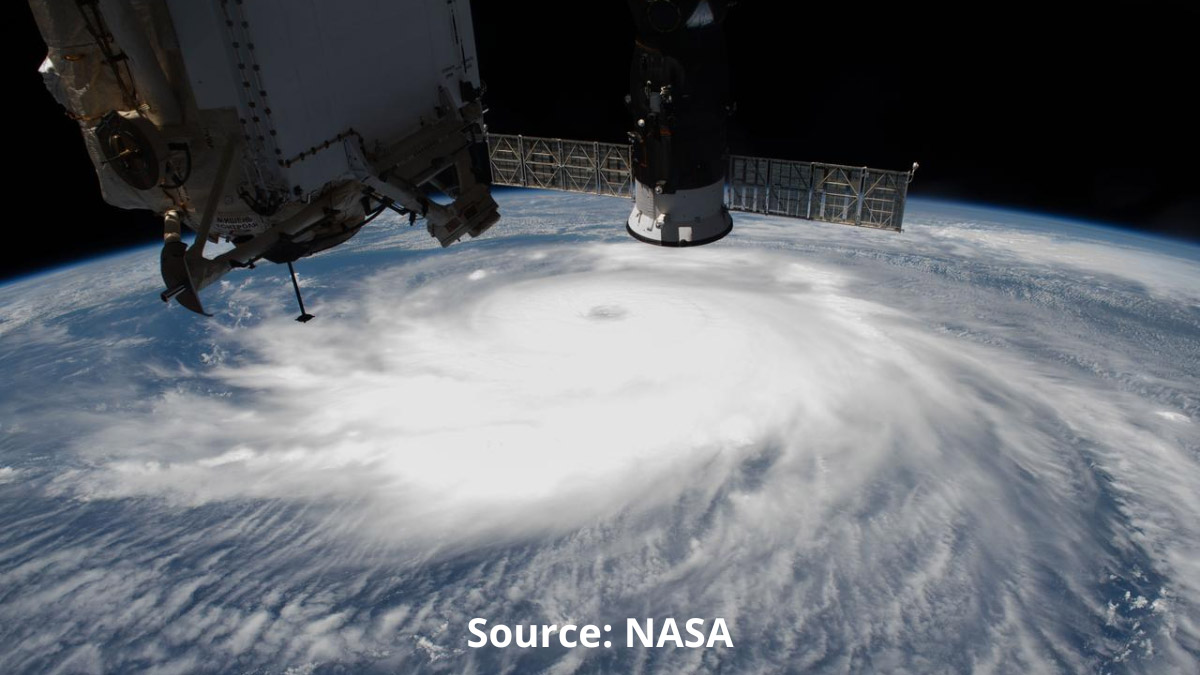

Hurricane Laura off the coast of the Texas-Louisiana border as the International Space Station orbited above the Gulf of Mexico. (Source: NASA Image and Video Library)

Hurricane Laura off the coast of the Texas-Louisiana border as the International Space Station orbited above the Gulf of Mexico. (Source: NASA Image and Video Library)

Last month, the Satellite Industry Association (SIA) released its annual State of the Satellite Industry Report (SSIR), which is widely considered the definitive analysis of the satellite industry’s economic performance. This year’s 27th edition of the SSI Report had some interesting findings in regard to the Earth Observation (EO) industry that might seem counterintuitive considering some of the recent headlines.

According to this year’s report, 2023 was another banner year for the satellite services industry, generating $110.2B of the larger satellite industry’s $285B in revenue. That amounted to a 2 percent year-over-year growth in satellite services revenue from the previous year.

In a statement to Constellations, a spokesperson for the SIA claimed that this growth was due to, “Faster and lower-cost broadband services, enhanced remote sensing capabilities, direct-to-device communication, and a growing number of space sustainability activities…”

According to the SSI Report, the improved remote sensing capabilities are a result of new sensors and imagery technologies, including multispectral, hyperspectral, synthetic aperture radar (SAR), radio occultation (RO), and RF mapping. The introduction of these new technologies and increased demand for imaging services catapulted the EO industry to $3.2B in revenue in 2023.

“Thanks to tremendous leaps in innovation, satellite EO and remote sensing have greatly expanded in the past five years,” said the SIA spokesperson. That fact is backed by the SSI Report, which claims a seven-time increase in the number of EO satellites in orbit from 2014 to 2023.

Despite these rather rosy statistics about revenue growth and the increased number of EO satellites entering orbit, not all of the recent news from the EO industry has been positive. Just a few weeks ago, Planet Labs announced that it was laying off 17 percent of its workforce. That was the second layoff for Planet in 12 months, with a previous layoff in August 2023 reducing the company’s workforce by 10 percent.

Some satellite industry and financial professionals see the layoffs from a large, established EO company as an indicator that the EO industry—as a whole—is overvalued or in trouble. But industry leaders, experts, and investors are adamant that some bad news from one company is not indicative of a larger, industry-wide problem.

As Aravind Ravichandran, the Founder of TerraWatch Space, recently told his Substack followers, “Following the announcement of the layoffs at Planet, I have seen some rather pessimistic, gloomy posts on the future of EO and why EO is not a good sector to be working in. I disagree.”

Broad Demand from Across Industries

Despite some “pessimism” and “gloom” around EO, there are numerous reasons why those within the industry remain bullish about its potential and future.

The use of commercial EO data within the military is already beginning to increase – with $50 million allocated by Congress for commercial EO services in the 2024 Space Force budget. In addition, numerous conversations at this year’s SATELLITE 2024 Conference and Expo centered around the use of commercial EO data and services to meet military ISR and battlefield intelligence requirements.

There are also ways in which civilian government agencies can leverage EO data – especially for agencies that predict weather and respond to natural disasters and emergency scenarios.

“Today, thanks to new technological innovations, remote sensing and imaging satellites are capturing optical, SAR, OR, and other multispectral data from space. Such data provides the ability to monitor and track cyclones and wildfires at night and through canopies, cloud cover, and smoke,” explained a spokesperson from the SIA. “RO atmospheric temperature, humidity, and pressure data are crucial as they help officials forecast and plan evacuations in areas predicted to be impacted by severe weather or wildfires.”

But government and military requirements are just one part of the EO picture. There is massive potential for growth as new industries and market sectors discover the benefit of acquiring and analyzing remote sensing data and insights.

Satellite image of a volcano eruption in Iceland in May 2024 (Source: NASA Earth Observatory)

Satellite image of a volcano eruption in Iceland in May 2024 (Source: NASA Earth Observatory)

“We’re actually invested in a few companies in the EO market. We were an early investor in BlackSky, HawkEye 360, and Ursa Space. All leading companies in their individual fields,” explained Mark Spoto, a Managing Partner at Razor’s Edge Ventures, a Venture Capital firm focused on technology companies that serve national security and high-growth commercial markets. “We were excited about these companies because they’re ‘dual-use’ companies that address big government needs and can springboard into commercial from there.

Razor’s Edge sees EO as an enabler for companies looking to better monitor their supply chains, have better insight into their assets, and monitor areas or operations that are too large or too far away to be monitored traditionally. “We can use EO data to enable real-time visibility into supply chains and show where assets are in the supply chain. We can even enable resource monitoring – allowing companies or governments to remotely monitor how much of a resource they have in their inventory…” Spoto explained.

But the expansion of EO into new industries is just one of numerous reasons why many see the EO industry poised for growth. New technology advancements and innovations promise to improve the quality and timeliness of EO data and services, making them even more valuable to users.

Advancements in Launch, Relay, and Data Fusion

It's one thing to get access to EO data, and it’s another to identify actionable insights from that data. Razor’s Edge’s portfolio companies—including Ursa Space—are working to make a difference in this area. Leveraging sensor fusion and advanced analytics solutions, these companies are working to help users of satellite imagery and data identify trends and patterns that they can use to benefit their business.

“Companies want insights. They don’t want a picture - they want to know what a picture means,” Spoto said. “By combining EO data with data science and machine learning, [EO companies] can identify insights that would be interesting for a wide range of customers.”

This will be further improved by sensor fusion technologies that allow EO customers to marry the data from multiple sensors to create an even more vivid, detailed picture from EO data. “Each of these companies is gathering a slice of data, but they’re realizing that – if they fuse their data together with other either EO data slices or other tactical data – they can provide more context, insight, and color,” Spoto said.

The evolution of machine learning (ML), artificial intelligence (AI), and sensor fusion technologies will open the door to EO data becoming more easily and rapidly useful for EO customers. But it’s not the only advancement that could improve EO offerings. Advancements in commercial space launch technologies could usher in the next era of EO data and Earth imagery – an era when larger satellites with more sophisticated sensors are generating even more accurate imagery for EO customers.

The introduction of larger, more powerful commercial launch solutions capable of carrying personnel and cargo into space could have an impact on the types of satellites that EO companies build and launch into orbit.

The advent of commercial launch systems opened the door to new satellite constellations – including many of the EO constellations in orbit today. However, the need to limit the weight and size of satellites launched via these services forced many EO companies to focus on manufacturing smaller spacecraft with smaller sensors.

A new generation of commercial launch spacecraft, including the SpaceX Starship transportation system, could reverse that trend, enabling EO companies to build and launch larger satellites with larger, more effective sensors and other components capable of creating higher-resolution Earth imagery.

“The Starship capability coming online from SpaceX is going to be a real game-changer that causes [EO companies] to think differently about how they've been building, designing, and launching satellite constellations,” explained Spoto. “For the last 20 years, EO companies were designing satellites smaller and smaller because launch costs were driven by weight and volume. Now, imagine if you can launch something without worrying as much about the mass.”

Finally, there’s the issue of timeliness. When trying to make real-time decisions, it’s essential that the EO data informing those decisions is as up-to-the-minute as possible. As Spoto articulated, “For any of this EO data to be tactically relevant, it's got to be really fresh.”

Unfortunately, many EO satellites need to hold onto their data for extended periods of time while traveling over areas of the Earth’s surface where there are no teleports. This also includes the 71 percent of the Earth’s surface that’s covered by water.

Traditionally, this latency has impacted the “freshness” of EO data, making it difficult to make real-time decisions based on satellite imagery, alone. In fact, this remains one of the reasons why commercial satellite data has yet to replace some military systems for capabilities like tracking moving ground targets. However, advancements in how satellites transfer data between themselves and the ground could help eliminate much of this latency and get commercial EO data back to Earth much more quickly.

The government and private enterprises are working to advance space data relay capabilities that would enable satellites to relay data via RF or optical communications to other satellites in orbit. This would enable an EO satellite at LEO to relay its data to a MEO or GEO satellite that could then transmit it to a teleport in its coverage area.

If you can relay EO data - whether it's to one of your own satellites, or up to one of the bigger relay constellations - you're taking that timeframe and compressing it,” Spoto explained. “Down the road, EO latency will be measured in seconds. That’s when it will really be valuable.”

No Time to Panic

Not all of the news about the EO industry in the past few months has been positive, but these gloomy headlines don’t tell the entire story. They fail to represent the potential that exists within the EO industry. There will be growing pains for this relatively nascent industry, but the opportunities that exist and new technologies on the doorstep have EO poised for rapid growth in the future.

As Ravichandran explained to his followers, “…is everything rosy in the world of EO? Not at all…Overpromises were made over the last few years…[and] we will continue to see repercussions of those in the next couple of years. But, we are course-correcting…”

Explore More:

Government and Industry Race to Develop Space Data Relay Capabilities

Expanding Earth Observation Opportunities and Data Access

Podcast: Satellite-as-a-Service, Data Fusion and Sovereign Earth Observation

The Complicated History of US Commercial SAR: Market Competition and National Security